Fascination About Bank Account Number

Wiki Article

Not known Facts About Banking

Table of ContentsOur Bank Account DiariesGetting My Bank Definition To WorkSome Ideas on Bank Account You Should KnowIndicators on Bank Certificate You Should Know

You can also save your money as well as make interest on your investment. The cash saved in many savings account is government guaranteed by the Federal Down Payment Insurance Policy Corporation (FDIC), up to a limitation of $250,000 for individual depositors and $500,000 for collectively held deposits. Financial institutions also supply credit rating chances for individuals and corporations.

Financial institutions make a revenue by billing even more rate of interest to debtors than they pay on interest-bearing accounts. A bank's size is established by where it lies and also who it servesfrom little, community-based institutions to big business financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured industrial financial institutions in the USA since 2021.

Though typical banks supply both a brick-and-mortar area and an online existence, a new pattern in online-only banks arised in the very early 2010s. These banks typically offer consumers greater rates of interest and also reduced costs. Convenience, rates of interest, and costs are a few of the factors that help customers determine their liked banks.

The Bank Ideas

The regulative setting for financial institutions has since tightened substantially as a result. U.S. financial institutions are managed at a state or national degree. State banks are managed by a state's department of financial or division of economic organizations.

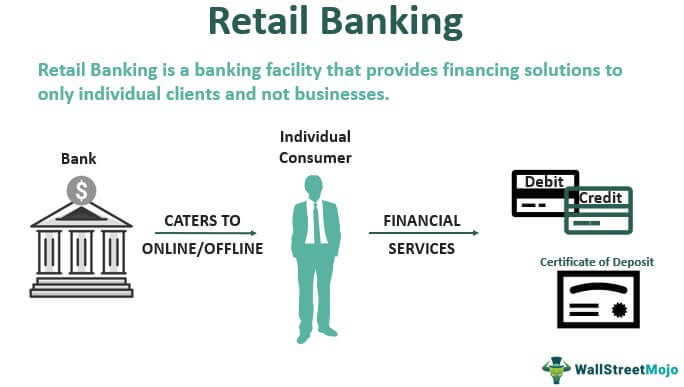

You must think about whether you intend to keep both service and also personal accounts at the same bank, or whether you want them at separate financial institutions. A retail financial institution, which has basic financial solutions for clients, is the most appropriate for everyday banking. You can pick a conventional financial institution, which has a physical building, or an on the internet financial institution if you do not desire or need to physically visit a bank branch.

, for instance, takes down payments as well as offers locally, which might use a more customized financial relationship. Select a convenient location if you are picking a financial institution with a brick-and-mortar area.

The Definitive Guide for Bank Draft Meaning

Some financial institutions also offer smartphone applications, which can be helpful. Check the charges related to the accounts you wish to open. Financial institutions bill rate of interest on fundings in addition to regular monthly maintenance fees, overdraft account charges, as well as cord transfer fees. Some big financial institutions are moving to end overdraft fees in 2022, to make sure that can be an essential consideration.Money & Advancement, March 2012, Vol (bank account). 49, No. 1 Organizations that pair up savers and consumers assist guarantee that economies function smoothly YOU have actually got $1,000 you don't need for, claim, a year and desire to gain revenue from the cash till after that. Or you wish to acquire a home and need to obtain $100,000 as well as pay it back over three decades.

That's where financial institutions can be found in. Banks do lots of things, their main role is to take in fundscalled depositsfrom those with money, swimming pool them, and also offer them to those who require funds. Financial institutions are middlemans in between depositors (that offer money to the bank) and borrowers (to whom the bank offers money).

Down payments can be available on need (a checking account, for example) or with some restrictions (such as cost savings and also see this here time deposits). While at any type of provided minute some depositors need their money, a lot of do not.

Getting The Bank Reconciliation To Work

The process includes maturity transformationconverting short-term obligations (down payments) to long-term assets (car loans). Banks pay depositors less than they receive anchor from customers, which distinction accounts for the mass of financial institutions' revenue in most nations. Banks can enhance conventional deposits as a source of funding by directly borrowing in the cash and also funding markets.

Banks maintain those called for gets on down payment with reserve banks, such as the United State Federal Get, the Financial Institution of Japan, and also the European Central Financial Institution. Financial institutions develop money when they offer the rest of the cash depositors provide. This cash can be used to acquire items and solutions as well as can discover its back into the banking system as a down payment in an additional financial institution, which after that can provide a fraction of it.

The size of the multiplierthe amount of money created from visit our website a first depositdepends on the quantity of cash financial institutions should maintain on book (banking). Financial institutions additionally provide and also reuse excess money within the financial system and create, disperse, as well as trade protections. Financial institutions have a number of means of earning money besides taking the difference (or spread) between the rate of interest they pay on down payments and also borrowed money and the interest they collect from debtors or safeties they hold.

Report this wiki page